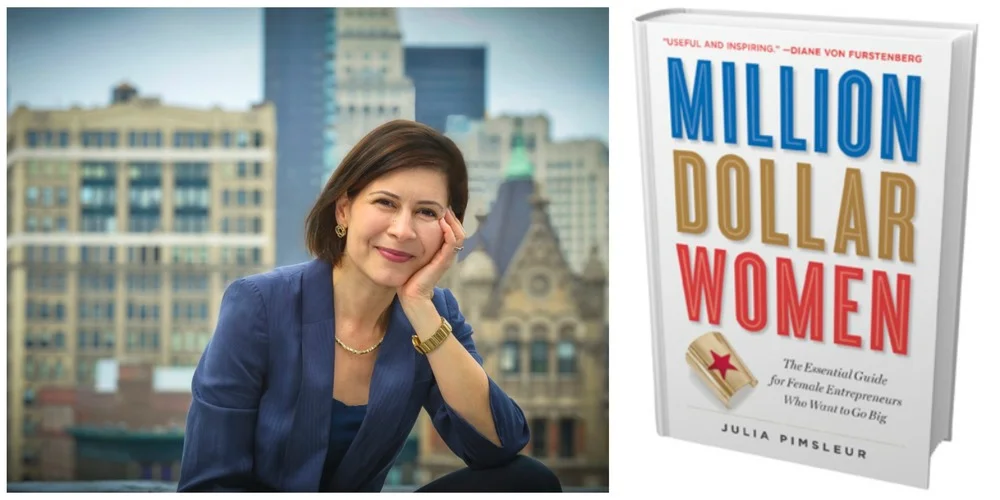

by Julia Pimsleur, author, speaker and coach, and the founder of Little Pim

When I started considering fundraising for Little Pim many years ago, I was instantly overwhelmed by everything I didn’t know and had so many questions that I didn’t know who to ask. Many of the women I speak to today have the same questions and fears....

- Am I ready to raise?

- I don’t know how to fundraise, so how can I?

- Do I have to face all those rejections?

- Will I have to give up ownership of my company?

Right now, women only receive four to seven percent of the $25B or so of venture capital dollars invested in businesses every year, and women tend to start their companies with six times less funding than their male counterparts. One of the reasons I wrote so much about fundraising in Million Dollar Women and cover it frequently on my blog is because I want to change that. I spent years learning the fundraising dance and raising capital is a big part of why I was able to take my own business past the million dollar mark. Now I want to help demystify fundraising for other women entrepreneurs.

For this blog, I asked my readers what fundraising questions they’d normally be too embarrassed or scared to ask. A big thank you for sending them in – you were helping hundreds of entrepreneurial sisters who would wish to ask the exact same things!

Where do I start when I decide to go after fundraising?

The first step if you are considering fundraising is determining what the money you would raise will help you achieve. Good questions to ask yourself to get started include:

- How will you use the funds?

- What increase in revenues will having more funds bring about? By when?

- How will the investors see ROI (Return on Investment) on their investment?

- Will you sell the company at some point, or do you plan to pay dividends?

Additionally, you’ll want to make sure your team is ready. You’ll be spending up to 50 percent of your time out of the office, focused on networking and fundraising. No matter whether your team is two or ten people, it’s important to be sure they can run the business while much of your focus is on finding funders.

What do I need to have ready before I start talking to investors?

First off, you need a pitch (follow that link for 5 tips on how to ace yours!) which tells investors what problem your company is solving, why you, why now, and what the big opportunity is. You’ll also need to have your internal systems in order when you fundraise, so you can quickly access information to send to potential investors. This means having things like your three-year projections, P&L, and Balance Sheet ready to go. You’ll want to have a solid financial model and a 15-20 slide PowerPoint or Prezi deck as well as a one-page executive summary.

You also must have a well thought out plan for what you’ll do with the funds, and how the funds will help you at least double the business in the short term, and hopefully lead to more like a 5-10 times return in the long run.

How do I go about targeting investors?

One way to meet investors is through intentional networking, but you can also go online to find investors with a history of investing in your type of company. I would recommend searching on AngelList or Crunchbase. On Crunchbase, you can do an advanced search for investors based on their location, portfolio, number of investments, and more. You can also check out Plum Alley and Circle Up, which are women-specific fundraising platforms, as well as my personal list of funding resources and accelerators. You can also take a page of Eloise Bune’s book. Founder of Handwriting.io, Eloise was in my first fundraising boot camp in 2012. She has since raised $6.5 million for her company and now works with major retailers like Target and Hallmark and her company isgrowing rapidly. Her method to find the right investors proved to be very effective. When starting out, Eloise made a list of the 50 most influential people she knew. Lawyers, other business owners, and people who had found success in what they do. She met them for coffee and had phone calls with them, talking to them about her vision.

Why this was so effective: successful people know other successful people. Eventually, Eloise networked her way into finding angel investors for her startup and a wonderful female mentor and board member. We’re lucky enough to have Eloise leading a fundraising workshop at the Million Dollar Women Summit in March where she’ll talk more about her journey and help other women just starting to fundraise map out theirs.

What do I wear when meeting investors?

The rule of thumb about what to wear in fundraising is simply to look as much like them as possible. As superficial as it may sound, it works. If you’re going to a conference to network with potential investors, always find out what the dress code is in advance and dress accordingly. When I pitched to Golden Seeds, an early-stage investment firm that focuses on women, I knew that many of them used to work on Wall Street. I asked a friend what kind of outfits and accessories would be appropriate and based on that advice, specifically bought big, gold costume jewelry and a silk blouse just for that pitch. My friend was spot on, and it helped me feel more comfortable when it came time to present in front of 150 women. In general, you want to avoid distracting anyone from you and what you have to say. Low-cut shirts, frilly clothing, messy hair, or over the top jewelry will take away from your pitch or even negatively impact their first impression of you at meetings. This is just one of the many do’s and don’ts for pitching.

What are the signs of getting a “yes” when I’m in the “get to know you” phase?

The key is not to go for the ask unless you’re 90% sure you’re going to get a yes. While you don’t need to have all of these things checked off the list to ensure a yes, they are some of the biggest telltale signs that you’re ready to make the ask:

- If you’ve emailed back and forth, which means they’re engaged with you

- If you’ve had several meetings (even better, they came to your office)

- If you have mutual friends or professional contacts, which helps boost your credibility

- If they have given you some advice and you’ve actually implemented it; they want to see that you’re coachable

- If they have talked about introducing you to other people in their network

- If they have asked you further questions about your company finances and responded positively

- If they have sampled your product or service

Is it good to have a mix of capital?

There’s a fairly usual sequence to what kinds of money you raise and in what order. People generally start with self funding by using their savings or getting a bank loan, then go to friends and family and/or begin crowdfunding. Crowdfunding can be a crucial step because it forces you to make a video pitch (and saves time since you don’t have to run around networking to meet investors) and gives you the confidence that you can raise money. But it can look easier than it is. If you do a crowdfunding campaign, keep in mind that some 70 percent of the donations will come from people you already know.

So you will still have to tap your own personal network to make it successful. Some entrepreneurs raise capital from both angel investors and VCs at the same time. In fact, when I was raising money for Little Pim, I did a $2.1 Million VC round that included capital from a fund and angels investors, both investors who had already put money into my company and new angels I met while practicing what I preach and doing intentional networking.

What’s a lead investor?

A lead investor is the first person who invests in your company, and that’s how your first real valuation is determined. Your company is worth whatever the lead investor is willing to accept as the “value” of your company. You might think your company is worth $10M, but if your lead investor is only willing to fund at $3M, then that’s your valuation. I’ve written about valuations in the past, but the truth is that there is no tried-and-true formula. It’s more of an art than a science.

What do I do if I just keep getting rejected?

The truth is that many people hear “no” 100-200 times before getting a YES. But every “no” you get brings you closer to a “yes.” If you keep getting rejected, turn to your advisors—especially if you keep hearing the same reason behind the “no” regarding your margins, revenue, model, or valuation. Your advisors will be able to help you come up with another strategy. One of my favorite quotes can be applied to this situation, “The definition of insanity is doing the same thing over and over again and expecting a different result.” (Albert Einstein). So if it’s not working, get some help from advisors or a coach.

What happens if I raise capital and something dramatically changes my business?

Many times, women say they don’t want to fundraise because they “don’t want to give up control.” If you’re on the fence about fundraising, think about your business like a pizza. You can either have a small personal pizza all to yourself or you can have a slice of a huge pie. What you may not realize is that angel investors actually get little to no control for their investment (when you own 1-3% of a company you don’t get to sit on the board or make strategic decisions), and the capital and connections they bring in may help your company be worth twice what it’s worth today. So it’s a trade off.

When I was fundraising for Little Pim I knew I was in an industry that was going through dramatic changes. It made a huge difference to have investors helping us think through the shifts in how video was being delivered and how we could keep reinventing our delivery methods to keep up. (In my nine years running the company, we went from sending DVDs to offering bundles, to downloading, to video streaming and finally to a subscription model). Investors were able to make introductions for us and basically act as additional ambassadors for our company.

It can be scary to let other people in on your executive decisions, but I found that when I embraced the new ideas and worked with investors, the company performed better and I slept better at night. Investors may help your business to scale to an international or multi-million dollar level. You can hit goals that you simply wouldn’t be able to achieve on your own or that you might achieve, but within a much longer timeframe.

If you still have questions you are too embarrassed to ask, send them to me at julia@julipimsleur.com. Good luck out there and feel free to borrow my favorite mantra that got me through fundraising when I was pitching: Fortes Fortuna Juvat. Fortune Favors the Brave.

Stay brave,

Julia

Julia Pimsleur is on a mission to help one million women entrepreneurs get to $1M in revenues by 2020. Julia is an author, speaker and coach and the founder of Little Pim, one of the few women-run businesses backed by venture capital in the country. Little Pim is the leading system for introducing young children to a second language and has won 25 awards for its proprietary Entertainment Immersion Method®. Its products are sold in 22 countries. Julia has raised a combined $26 million in non-profit and for-profit dollars. She wrote “Million Dollar Women: The Essential Guide for Female Entrepreneurs Who Want to Go Big” to help women learn to raise capital and take their businesses further, faster. www.juliapimsleur.com