By the Lionesses of Africa Operations Dept

“…a company cannot achieve long-term profits without embracing purpose and considering the needs of a broad range of stakeholders. A pharmaceutical company that hikes prices ruthlessly, a mining company that shortchanges safety, a bank that fails to respect its clients – these companies may maximize returns in the short term. But, as we have seen again and again, these actions that damage society will catch up with a company and destroy shareholder value.”

So wrote Larry Fink, CEO of Blackrock, in his January 2020 letter to shareholders. Mr. Fink has been named one of the "World's Greatest Leaders" by Fortune, and Barron's has named him one of the "World's Best CEOs" for 14 consecutive years. 14 years!! Blackrock is also the world’s largest investor - in their own words: “[the] firm is trusted to manage more money than any other investment company in the world.” Yes - so important to constantly remind yourself, you are ‘Trusted by your customers’. Remind yourself that daily and you will never become complacent.

BlackRock recently surveyed clients around the world, representing U.S.$25 trillion in assets under management, to understand the shift towards sustainable assets and how the CV19 may have affected it. Their findings were clear: “The tectonic shift towards sustainable investing is accelerating.”

However they do note that data is the major challenge (as we showed previously here).

“53% of global respondents cited the poor quality or availability of Environmental, Social, and Governance (ESG) data and analytics as the biggest barrier to deeper or broader implementation of sustainable investing”, this was higher than any other barrier they found.

[It should be noted that ESG, SRI (Socially Responsible Investing) and Impact Investing are all for the purposes of this letter taken under the larger banner of ESG, although in practice they do differ, here, AND all are worthless in our view, if there is only talk and no impact.]

Peter Drucker, one of the guru’s of modern business management wrote: “What gets measured gets managed.” and this is more true now than ever with incredible advances in research and development around the globe giving very little excuse not to measure such essentials as ESG and impact.

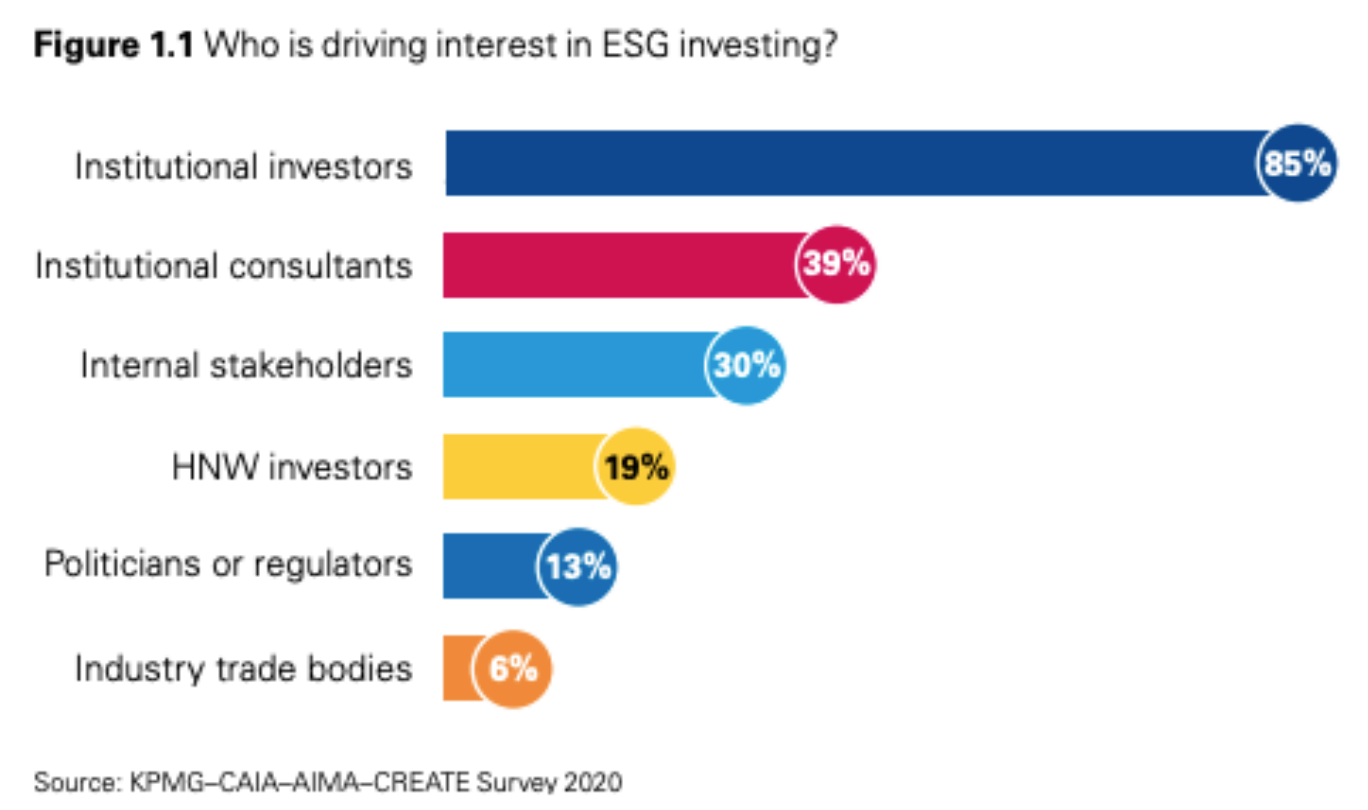

Digging deeper, we note that in the recent report by KPMG ‘Sustainable investing: fast-forwarding its evolution’ they note:

“Until fairly recently, [Institutional] investors have been mostly focused on uncorrelated absolute returns. They now want their investments to target double bottomline benefits: do well financially by doing good socially and environmentally…Specifically, they want their hedge fund managers to…target positive environmental, social and governance outcomes, on top of the financial ones.”

That is a huge push by Institutional Investors and, where they put on pressure, they have through their investments in the Hedge Fund Industry (and the tremendous power these funds yield), forced others to follow. This is spreading with an Australian Student now turning to the courts because her Government “[failed] to disclose climate-change risks to investors” seen here.

In the Green Economy there is a serious push against ‘Green Washing’ whereby those who say they are Green, now have less excuse not to show their audited or certified ‘Green’ credentials. Given the huge investment in Green solutions over the past 20 years, where ‘Green’ leads, so we follow, and that is why we at the Lionesses of Africa are determined to drive the African Women Led Business research and data gathering in the future. As the fastest growing and largest community of women entrepreneurs in Africa we have a responsibility to lead the way in shining a light on the difficulties and issues faced daily by our huge membership (currently standing at >1.1 million across Africa and the Diaspora), and to bring together interested parties to find meaningful and impactful solutions to both finance and supply chains.

Supply Chains?

“Big businesses spend trillions of dollars on suppliers every year, yet just 1% goes to businesses owned by women.” Global Citizen.

If as Mr.Fink says: “Ultimately, purpose is the engine of long-term profitability.”, why not measure the potential impact to the double bottomline (both a financial return (the conventional bottom line) and positive social impact), in welcoming new suppliers and especially female owned suppliers?

However - In a year when Resilience, Security and Speed were the buzz words for supply chains, is it fair to push for a change to what worked so well during a tumultuous time? Surely “if it ain’t broke, don’t fix it” remains true?

For the most part supply chains worked extremely well with very few headline collapses and apart from the usual panic rush on Toilet Paper in the UK (someday psychologists are going to tell us why this is so much more a problem in the UK than elsewhere in the world. We all agree that the Italians have got it right, pasta and wine were bulk bought, although according to the HoF, one can never have too much coffee stored away for dark days…).

But the fact remains that there is very little representation of women in large global supply chains. Talking to one supply chain guru he said that male or female has never been a concern in his decision making (he ran supply chains >$1 billion annual spend), just that the company he was buying from had to have resilience, there must be security of supply and ultimately it must offer value (note value, not cheap price), because that is what his end customers demanded. This we all completely agree with. As always, women entrepreneurs and Lionesses are not looking for charity, just to be heard on an equal basis. But it is this getting on the first rung of the ladder that seems the most difficult. The only thing that anyone can ask of another is to give them a foot in the door, from then on it is the products, the value, the service that will do the talking.

So how do we get a foot in the door? It would appear that although many more companies are looking at the double bottomline benefits of ESG, a 1% result for women suggests that it is not catching on with their procurement team. If part of the ‘double bottomline’ is that it encourages more institutional investment and less short selling by the Hedge Funds, then if you can cover the essential ‘resilience’, ‘security’ and ‘value’, this must be a win-win surely?

According to the CFO.com:

“Unfortunately, today, procurement is too often mired in process. Putting together supplier agreements and managing supplier relationships doesn’t begin to approach what this function can contribute and does contribute in strategically-minded finance organizations. By our estimation, only about 10% of Fortune 5000 companies currently even have a chief procurement officer. Procurement tends to be managed at the director level of the company. Worse, it is relegated to a once or twice year sourcing activity that doesn’t make a strategic impact on the organization or to the bottom line.”

If that is correct, it is no wonder that in many companies strategic decisions take so long to water down to the procurement team and through them to welcoming women-led businesses into their suppliers’ lists.

Sadly we come up against a typical Chicken and Egg situation. Resilience (of company to weather storms and be there for the long term) demands data such as 3-5 years of audited reports, and Security (of Supply to ensure that your suppliers’ own supply chain is not let them down and in turn impact your essential supply). Much of this requires finance that as we have seen is also not so readily available to women run businesses. If large companies with major cross national or continental supply chains wish to change things for the better, it is therefore up to them to go the extra mile.

Such an extra mile was seen earlier this year from Unilever who made available in March 2019 as CV19 hit hard, €500 million of cash flow relief for small and medium sized suppliers and customers. MNC’s such as Unilever have a responsibility for the world that they clearly take seriously, so we are sure they weren’t alone and granted this was for their own suppliers and customers, but this was not an overnight ‘Road to Damascus’ transformation, simply part of a road they have been purposefully travelling for sometime it appears. In the 2017 report by Unilever: “Opportunities for Women: Challenging harmful social norms and gender stereotypes to unlock women’s potential”, Paul Polman, CEO of Unilever stated:

“I’ve always believed that women have been undervalued. When we empower women, society and the economy benefit, grow and thrive. That’s why this topic is called out specifically in the UN’s Sustainable Development Goal 5. But we also know that Goal 5 actually permeates all the others. If we fail to tackle gender inequality, the rest of the goals are likely to fail too.

Fortunately, the private sector has an opportunity to make a real difference – in employee policies, in hiring practices and through the value chain. And it makes enormous economic sense too, with an overwhelming number of studies showing time and time again that gender equality is good for talent development, culture, innovation, leadership and performance…. If business works in partnership with governments and civil society and leverages the size and scale of global value chains like ours, we can achieve a breakthrough.

It isn’t just about empowering women and girls because it’s the right thing – our vision of a prosperous, poverty-free world depends on it.”

This is Mark Twain’s ‘Why’.

Stay safe.