Feature

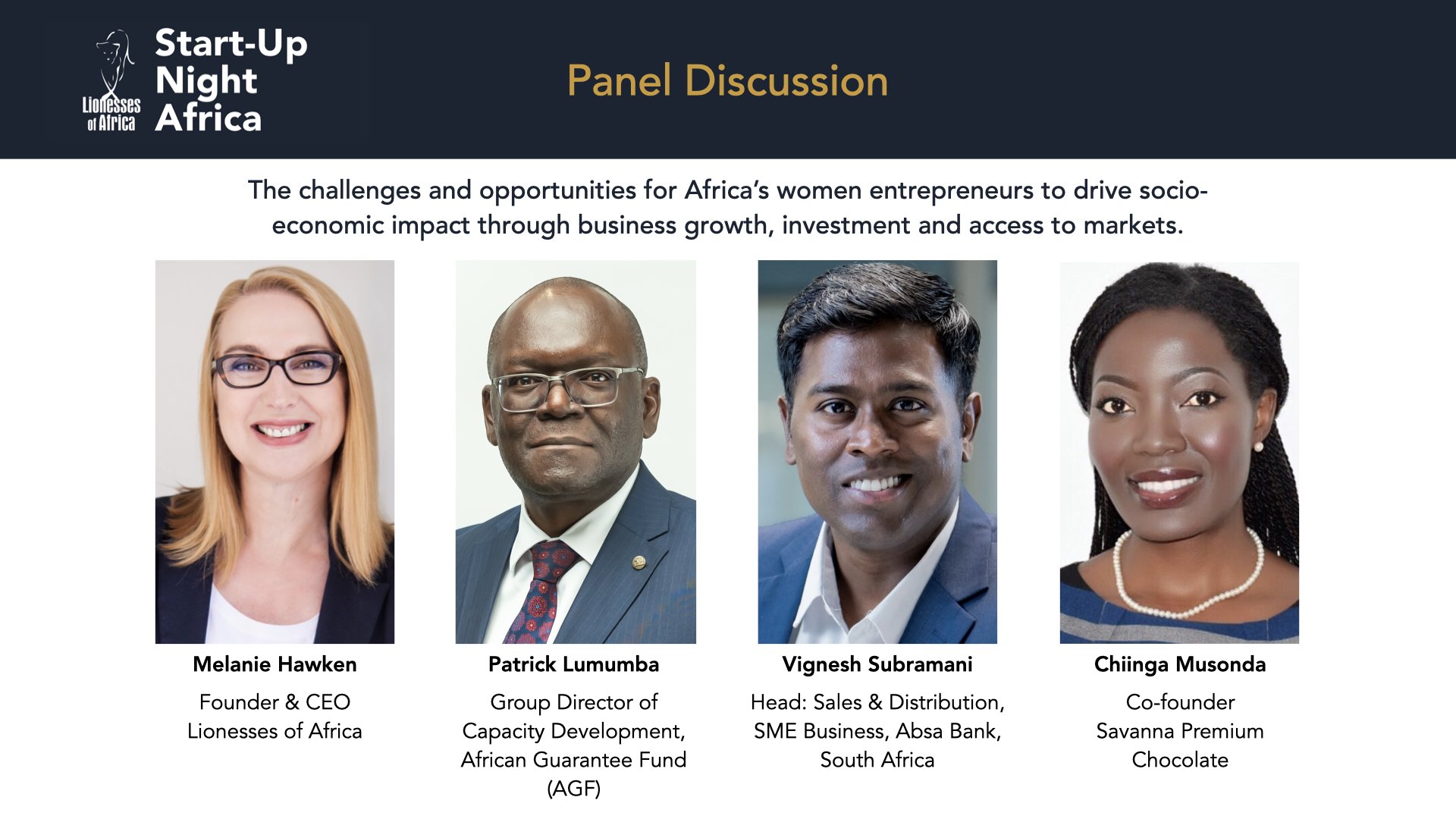

Over the past eight years, Start-Up Night Africa events have aimed to stimulate real change by bringing together women entrepreneurs, with decision-makers and policy-makers, to discuss the challenges and real solutions needed to close the funding gap. At this year’s event on 11 June 2024, in The Hague, The Netherlands, a highlight of the programme was the panel discussion, where invited guest experts shared their insights and knowledge on the challenges women entrepreneurs face in getting access to finance and growth market opportunities. The focus was on discussing what progress has been made over the last twelve months, and also what new initiatives have been launched to practically shift the dial for women entrepreneurs in getting access to the growth funding they need. Chairing the panel discussion was Lionesses of Africa founder and ceo, Melanie Hawken, who was joined live on stage by Chiinga Musonda, co-founder of Savanna Premium Chocolate from Zambia. Joining via Zoom link were Patrick Lumumba, Group Director: Capacity Development at the African Guarantee Fund, and Vignesh Subramani, Head: Sales & Distribution, SME Business at Absa Bank, South Africa.

The conversation kickstarted with a reminder to the audience of the continuing challenge of women entrepreneurs getting access to growth funding, but with the positive news that much work has been done over the past year to improve the situation. Melanie invited Chiinga Musonda to share with the audience her experiences of growing her award-winning bean-to-bar chocolate business over the past year since pitching at the event in 2023, and what support she is looking for this year to help her business to scale further.

Click thumbnail below to watch the video of the panel session:

Chiinga said: “It’s been a good year, but still very challenging in a lot of ways. We're still looking for two types of funding - the main one that we consider is debt, but the interest rates continue to be high if you're looking at the local market. The second one is investors, but when you look at the local market you actually have very few investors, whereas talking to international investors, some say they don't understand the African market. So that continues to be a challenge. On the brighter side regarding the business, our aim is to really grow the manufacturing process within Africa, so we are in Zambia at the moment as well as Tanzania, but we are also expanding to Europe. We are looking for distribution partners. In terms of new market access, it took some time to get the right export licenses that we needed, and we had to find a way around the duty tax, which is pretty high if you're exporting from Africa. Chocolate is considered a luxury product, which it shouldn't be because for people who are importing or exporting from the US, it's actually much cheaper for them than for an African who’s actually doing business to export to the Netherlands or to the EU.”

Having gained insights from a woman entrepreneur’s perspective in getting access to funding and new markets, the focus of the discussion changed to how financial institutions are bringing practical solutions to the table. Patrick Lumumba was asked to share his insights on the positive, impact-driven work that African Guarantee Fund has been doing over the past year to empower both women entrepreneurs and financial institutions to close the access to funding gap.

“We are creating solutions along these financing value chains to support the players both from the supply end and the demand end. Addressing those challenges is critical for this value chain to be strong.”

- Patrick Lumumba, Group Director: Capacity Development, African Guarantee Fund

Patrick said: “The solutions are being found, the landscape is changing, and various stakeholders are changing, albeit slowly. We are looking at better policies and legal frameworks, and critically for African Guarantee Fund, in partnership with African Development Bank through their AFAWA initiative. We are creating solutions along these financing value chains to support the players both from the supply end and the demand end. Addressing those challenges is critical for this value chain to be strong. From the supply end, which are the financial institutions, we mostly work with the banks, and we recognize that there are issues that need to be changed in terms of perception. Within a bank, for instance, some staff ask why there should be a specific women’s value proposition and what makes them different from all the entrepreneurs? So these are the aspects that gradually we are addressing, changing those perceptions for them to appreciate the unique challenges experienced by women SMEs, and the need for them to have a standalone product that addresses their needs comprehensively.”

Having acknowledged the challenges that women entrepreneurs are still facing in growing their business, Patrick went on to discuss the practical support being provided by African Guarantee Fund to help both financial institutions and women business builders to close the funding gap. He also discussed the importance of the power of partnerships to drive the necessary change.

Patrick said: “We support financial institutions to come up with the right products, and train their staff to do appropriate credit appraisals for women SMEs. At the demand end, that is the women SMEs, we also appreciate that there is need for them to be better prepared in terms of being ready to uptake credit or financial solutions that are being offered. This is very fundamental for us. That's the reason also why we intend to partner with Business Development Service (BDS) providers such as Lionesses of Africa, to address those particular challenges. On the positive side, we appreciate the fact that women entrepreneurs are very strong and versatile, and the aim is now to position themselves, get to know as much information as possible, because there are solutions. Technology is available, women entrepreneurs can align themselves with the different networks offering different solutions. At AGF, we have tailor-made our capacity development programmes to financial institutions and to women SMEs, and we are also providing our highly discounted guarantees for banks such as Absa Group, who is one of our banking partners.”

In her role as Chair of the discussion, Melanie commented on how one of the goals set at the Start-Up Night Africa event was to see real change happening for Africa’s women entrepreneurs in getting access to funding and capacity building. She recognised that improving access to funding doesn’t happen on its own, it takes the power of partnership to make that happen. The African Guarantee Fund, in partnership with African Development Bank through their AFAWA initiative, with the support of banks such as Absa and women entrepreneur organisations such as Lionesses of Africa, are providing the strategy, programmes and collective will to make positive change a reality.

“In October last year, we launched She Thrives, a women in business proposition specifically tailor-made for women entrepreneurs in South Africa. Subsequently, there was an announcement made by the African Development Bank on the approval of Absa from a funding line perspective with specific focus on youth, SMEs, and women-owned SMEs, a ‘first of its kind’ proposition.”

- Vignesh Subramani, Head: Sales & Distribution, SME Business, Absa Bank, South Africa

Providing the insights from a banking partner perspective, Vignesh Subramani was invited to share what Absa is proactively doing to support women entrepreneurs on their business growth journeys. He said:

“We've been really busy, really hard at work, since I was in the Netherlands with yourselves at Start-Up Night Africa last year. We were in the process of gathering our insights, doing a lot of research around women entrepreneurs, what their specific needs are, and we couldn't disclose too much at the time because we were busy doing the work behind the scenes. In October last year, we launched She Thrives, a women in business proposition specifically tailor-made for women entrepreneurs in South Africa. Subsequently, there was an announcement made by the African Development Bank on the approval of Absa from a funding line perspective with specific focus on youth, SMEs, and women-owned SMEs, a ‘first of its kind’ proposition. Since then, we've been working very closely with the African Development Bank and doing a few things, one of which is an access to finance element that we've built into the proposition. Through the support of the African Development Bank, we're now curating very specific programs, particularly from a non-financial support point of view. We’re continuously building onto those propositions and enhancing them further. Now we have a key focus on access to funding. For example, we believe that you shouldn't have to pay money to get access to funding. So we're waiving those initiation fees with regards to the lending instruments that we give to women entrepreneurs. We believe we have the right proposition which we've taken to market, and we will build on it. These are just some of the ways in which we're availing those benefits to women entrepreneurs. So we've been really hard at work and we continue to do so. This was a great platform for us to come and share some of the work that we've been doing since last year.”

Melanie asked Chiinga to share her thoughts on these new developments and also what else is needed to support women entrepreneurs with both access to funding and to new markets. Chiinga said, “I think it's fantastic. I think the only way we make a change is having dialogue and then taking action around it. From my perspective and looking at the bigger picture of what's happening in Africa, African women are running 40% of the SME businesses, but they only get less than 1% of venture capital funding. That needs to change. So I'm really happy to see the work that African Guarantee Fund and banks like Absa are doing. But there's so much more that banks can do, so much more that investors can actually do. If women are running businesses and they're successful, why not invest in them? Because they're capable.”

“When you look at the local market you actually have very few investors, whereas talking to international investors, some say they don't understand the African market. So that continues to be a challenge.”

- Chiinga Musonda, co-founder, Savanna Premium Chocolate, Zambia

In closing the discussion, Melanie asked both Patrick and Vignesh to share their organisation’s goals for the year ahead in delivering on the commitment to improve the access to funding landscape for Africa’s women entrepreneurs.

Patrick said: “African Guarantee Fund is focused on 43 countries at the moment and expanding. We want to on-board as many bank groups as possible so that we're able to cover every corner of the continent, including the fragile countries which have been neglected. We want to unlock funding to the tune of $2 billion, based on our partnership with AfDB, and provide very targeted technical assistance to prepare women SMEs to access that funding. Our mantra is more strategic partnerships, more banks, more stakeholders, more investment, and more credit ready women SMEs, so they are able to grow and transform their economies in African countries.”

Vignesh added, “I'm pleased to announce that since we launched the She Thrives proposition in the middle of October, we've had literally thousands of women entrepreneurs reach out to us and sign up for the offering - and we want to get to thousands more. We are a Pan-African bank and we have representation in a number of countries. We encourage women entrepreneurs to leverage our support, engage us so that we can put you in touch with trade and working capital solution specialists who can create those links into other African countries if you are looking to go cross border with your businesses. We have the ability to do that. So that's really our commitment and we encourage women entrepreneurs to reach out to us and engage because we have we have the solutions.”

In closing the panel discussion, Melanie thanked all the participants for their insights and congratulated them on the tangible progress made over the past year to shift the dial on support for women entrepreneurs. She reminded the audience about the power of partnerships of make positive change happen, and once again took the opportunity to thank African Guarantee Fund and Absa for their partnerships with Lionesses of Africa.

About the panelists

Vignesh Subramani, Head: Sales & Distribution, SME Business, Absa Bank, South Africa

Vignesh Subramani is a seasoned banking executive with over 19 years’ experience within Personal and Business Banking. The numerous roles he occupied have contributed to his strong business, leadership, and strategic abilities. His forte lies within Business Banking, with specific expertise in small and medium enterprise segments. Vignesh has shown the ability to deliver objectives through the people he worked with, by building and leading high-performance teams through committed and engaged team members.

Patrick Lumumba, Group Director: Capacity Development, African Guarantee Fund

Patrick Lumumba is a development finance specialist with experience spanning over 20 years working directly with different financial institutions in Africa, as well as international development organizations. Prior to joining African Guarantee Fund (AGF), he was the Head, Social Performance Management for Grameen Foundation covering the Africa Region. A Kenyan national, Patrick holds a Master’s Degree in Marketing from Kenyatta University, and is a Certified Expert in Climate Finance and a Certified Expert in SME Finance from Frankfurt School of Finance and Management. He is passionate about impact and capacity enhancement along the different development finance value chains in Africa.

Chiinga Musonda, co-founder, Savanna Premium Chocolate, Zambia

Chiinga Musonda is the co-founder and global ceo of Savanna Premium Chocolate, Zambia’s first bean-to-bar chocolate manufacturer founded in 2018. It is a woman-owned company that hires women from underprivileged backgrounds. The company’s products are sold in specialty stores, supermarkets, hotels and corporations in Zambia and Tanzania. It uses the finest single-origin natural cocoa beans, exotic fruits, and superfoods from Africa (e.g., Moringa, Baobab). Savanna Premium Chocolate purchases its cocoa beans directly from a women’s cooperative to ensure the best and freshest quality while empowering them to create sustainable futures through direct trade. It is the first African-grown and produced chocolate to win the International Chocolate Awards, and is now focused on growing its international markets.