by Lionesses of Africa Operations Department

“Investing in women’s entrepreneurship is good for business, and essential for economic growth.” These are the opening lines of a paper by the World Bank’s IFC entitled “Women owned SMEs: A business opportunity for Financial Institutions” (here) from 2014.

Given the MDGs and then the SDGs have been going since the year 2000, and yet to this day funding for women-owned and led businesses is still at an embarrassingly low level (2-4%!) across Africa (here), and we are now in the UN SDG ‘decade of action’, one surely can’t be blamed for asking where it went wrong? Was ‘action,’ and by that we assume they mean ‘delivery’, not on the agenda for the first 2 decades? If you look at many of the Annual Reports from the development industry, there certainly seemed to be a great deal of ‘learning’ during that period. Yet results, especially for women searching for finance in any and all of its forms, are still very lacking.

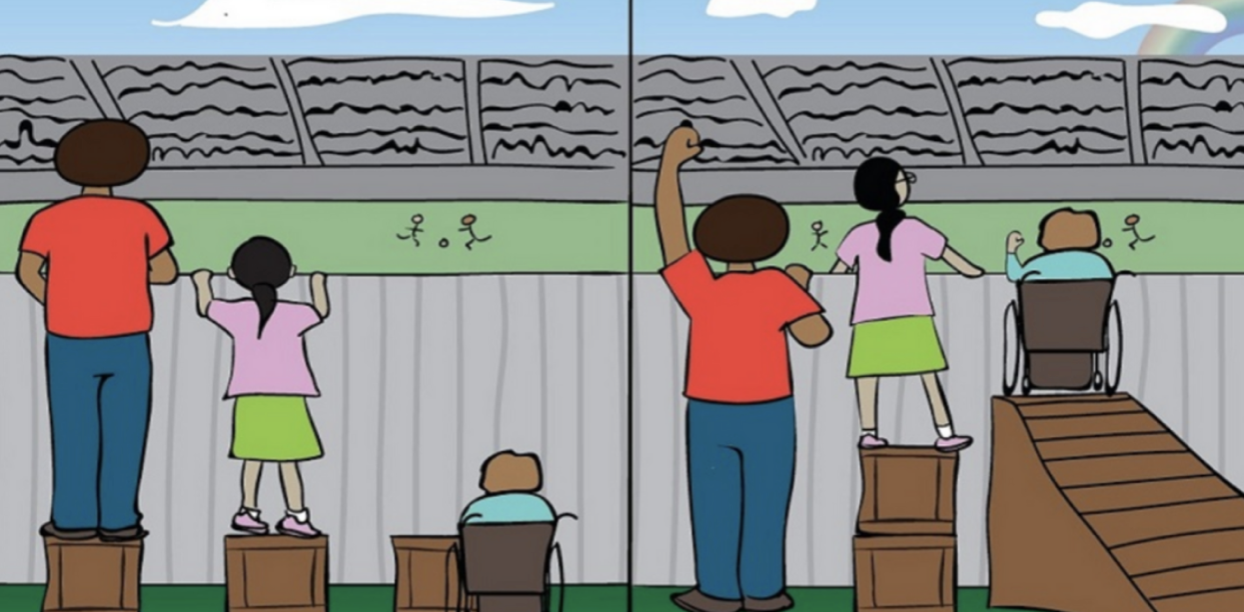

Perhaps delivery was just too difficult, perhaps the world was looking at this the wrong way. Not a day went by without Equality being pushed and indeed that is absolutely, absolutely right. However, in finance, given the numbers we see each month and year, that route of Equality, where one treats everyone as equals and then waits for the results to filter through, clearly failed and continues to fail. So we take a deep breath and ask the difficult question: Is it even possible to have Equality in finance? And if not, what is the solution?

Let’s be blunt. The building blocks for finance are built to be equal, but in fact due (in the most part) to historical reasons, they are iniquitous. For example, one major building block of finance is the credit worthiness of the business or person to whom one lends, yet as The World Bank state in their report ‘Women, Business and the Law 2023’ (here) many countries don’t even allow women to own property or land: “Only 14 countries…[show] an equal legal standing with men across…mobility, workplace, pay, marriage, parenthood, entrepreneurship, assets, and pensions…”

No wonder (World Bank again here): “Female entrepreneurs in Africa have systematically lower levels of business capital – including equipment, inventory and property – relative to their male peers…the typical male-owned firm has over six times the capital investment of female-owned enterprises.” No shock then that women cannot find the average (note average) of 211% collateral that is required to secure a loan in Africa (here)?

The WEF say it will take 132 years to close the Gender Gap (here), or 286 years “if the current rate of progress continues”, according to the UN Women and UN DESA (here). That is having pushed Equality already hard.

So let’s take a moment to peal back the Onion. Those at the top are boasting of huge money mobilised for women led businesses, according to the 2X Challenge (here) “…from 2021-2022: “Our flagship initiative raised gender lens investments totaling US$ 16.3 Billion…benefitting 473 businesses across all global emerging market regions”. Ok, so it’s a huge Onion!

Yet in spite of huge amounts of DFI money flowing into banks and funds (>70% of 2X Challenge money flows into FIs here), women led businesses are still stuck at the 2-4% - so what is happening?

Returning to our friends at the IFC, they along with WeFi, did an excellent study on the power of accelerators, to see the impact both for those raising equity capital and those raising debt. Was there a different result if male or female led?

They open their report (here): “Research shows that financial capital is one of the most critical resources for a growing company: young companies that access outside financing are able to grow up to 30% faster than those that do not.”

We believe that this is the crux of the issue. If you feed a sportsperson steroids, they will be better, stronger, faster than those with less or no steroids. As this report recognises this can be a 30% advantage, so no matter how many times we see that women repay better, or grow their returns in a larger way for each US$1 invested (see here), they will always lag behind as this 30% difference makes male led businesses gain yet more investment, and again…and again… ‘Money begets money’ as the saying goes.

What the IFC found in their study was that with equity raising, a male led business will pull away from a female led one, exacerbating the gender financing gap by 2.6 times, concluding “…acceleration has little to no effect on the ability of female-led startups to raise equity”. But in debt financing: “…female led startups increase[d] the amount of debt they raise by nearly 2.5 times as much as female-led startups that did not participate”. But here’s the kicker. “Female led startups, on average, [still] raise $7,000 less debt - compared to $15,000 less equity - than their male-led counterparts.” So they still raise less!

Shockingly they conclude: “The persistent gender financing gap cannot be easily attributed to differences in the quality of the startups, suggesting that investor bias and risk perception may play a role.”, adding: “There are no clear accelerator program design elements that overcome the gender financing gap…interventions will need to be more holistic, reaching beyond addressing startup behaviors and focusing on influencing the behavior of investors…”.

So what everything seems to be suggesting is that if we look purely at Equality and then sit back and wait for it to even-out the gender funding gap, not only will we have to wait 132 or 286 years, but in the meantime male-led businesses will simply continue to accelerate away with each larger injection of capital, confirming to the evermore powerful AI that only men can run businesses, and so yet more finance will flow to male run, and so on - Q.E.D.

Why is it then that we are not discussing Equity rather than Equality? Equality simply is not working at the speed the globe needs, yet women led business obviously have different circumstances - this does not mean they are weaker, simply different circumstances, whether it is as the IFC suggest inbuilt ‘investor bias and risk perception’ or historical issues that have created little or no wealth. These are different circumstances.

Equity, however, allocates the exact resources and opportunities needed to reach an equal outcome. Nothing more, nothing less.

“But,” we hear - “we do not have a 2X for men, we do allocate resources and opportunities just to women!” But it is how it is allocated that perhaps is also part of the problem.

Dalberg recently did an audit on the 2X Challenge results and they saw that: “Most Members are simply adding an additional layer of 2X screening to their existing investment processes, rather than changing their investment guidelines and criteria (i.e., Members are still looking for the same risk and return expectations, ticket sizes, etc.)”, but most Lionesses are stuck in the so called ‘missing middle’ of US$200k to $2million, they will not have the same risk and return as a male led built on better access to funding. Or leaning on ‘commitments to fulfil’ rather than actually ‘fulfilling’ the 2X Criteria, such as one: “Aiming to employ at least 30%women”. C’mon! If there is one thing you can guarantee, it’s that Lionesses 100% fulfill at least one of the 2X Criteria, often 3! Why the need to scrape the barrel?

The world also talks about the importance of SMEs (employment building etc) yet DFIs are now so huge they claim they simply cannot perform meaningfully at that level. Dalberg confirm for the 2X here: "Average deal size (~USD 50M) is over triple the median deal size (~ USD 16M), reflecting the presence of some significantly larger deals [and] 39 deals exceed USD 100M in size”. It is well known that the time and energy to do a US$2mil deal is almost the same as a $50mil one, as a $100mil one, so as funds grow past the $50mil mark, they too have to move away from the ‘missing middle’ deals - at $100mil AUM, there is no chance. This is why so often DFIs flow their support through large western banks to large developing national banks, to smaller banks, to Microfinance until they hope it hits the target. As Dalberg confirm, the “…challenge for direct investments to meet DFI ticket size requirements.”

We get all that, but somehow we still have to reach women led businesses direct, we have to ensure that ‘commitments’ are not the same as ‘fulfilling’ the 2X Criteria, and reach the missing middle, and as early in their business lifecycle as possible, because the gap starts at birth and just widens with each passing year.

Daily we speak to Lionesses who have amazing businesses many solving incredible global issues, but they have issues that are stopping finance reaching them, such as collateral, FX issues, pre-payment for stock to support small holder farmers - even the exit for their first investors if female (see here) and so on. Of course male-led businesses have the same or most of the same issues, but are we really going to rely on Equality rather than Equity to solve this? How’s that been going so far?

286 years is a long time for anyone to wait.

Stay safe.