By Lionesses of Africa Operations Dept

Since our previous letter in March on the EU’s move to legislate ESG to all via the financial world (here), where financial companies marketing their products within the EU now have to prove if they are ESG compliant (or not, they do have the choice). To take this seriously at a high level and to show this is not just a tick-box exercise, there is no doubt now (as we foretold) that this will filter quickly through to corporations and their supply chains. The finance world (if it wants the ESG tick) must pay attention, research, investigate and invest with ESG in mind.

Is this a good thing, or will there be unintended consequences that will hide the good and great work being done elsewhere? For example in the various SDGs covered by our inspirational membership (now 1.2 million strong). The HoF was speaking to one of his banking pals this week who said that meeting the ESG requirements is being discussed and enacted across all departments. Discussions with clients on lending, on issuance of bonds, notes, IPO’s and indeed M&A all now include ESG compliance.

This does not mean that there will be instant bans on flying; that electric will replace petrol or diesel cars starting from tomorrow; coal or gas fired power stations will be shut down; indeed there are very few countries that overnight can switch totally from carbon fuels to green, and so at a minimum gas powered power stations will be with us for many years. One can also not forget that the development world (currently the worst offenders in the carbon world, could rightly claim (and are) that the ‘west’ has an unfair advantage given that its industrial revolution happened centuries ago when no one really cared about smoke filled lungs. Although to be fair, according to Peter Brimblecombe in his book "Attitudes and Responses Towards Air Pollution in Medieval England” (the HoF’s bedtime reading never fails to surprise…), the fears over smoke in the lungs were first mentioned in the 12th century leading (in the following century), to King Edward I, banning the burning of ‘sea-coal’ in 1272. Still, the developing world does have a point.

As many have recognised, even Greta Thunberg, it will be impractical to stop all flying, and we agree as face to face meetings (in spite of our overnight change to zoom meetings), and factory, farm and mining visits will still be necessary. But there are many other ways one can cut our own carbon footprint, although not everyone has the willpower to become Vegan overnight - as the old story goes:

‘There was a 137 year old French lady. She was interviewed about the secret of her long life. She told the journalist: “I don’t smoke, I don’t drink, I’ve never gambled, I eat frugally, and exercise each day.” He then asked: “does that mean you will live forever?” “No, but it feels like it,” she replied in a resigned tone….’.

…but as the title of Greta Thunberg’s book makes clear “No One Is Too Small to Make a Difference” (here), we can all do our bit personally. What the EU’s regulations mean is that companies and especially the large corporates who are used to being reported on the front pages, need to be very careful to ensure ESG means ESG.

So how will all of this be measured? What will give the incentive for all these companies to truly change? As we mentioned in our last letter on this subject (here), there have been some very ‘interesting’ uses of ‘Green’ Bonds from companies that haven’t a green bone in their corporate bodies, yet were bought aggressively and over-subscribed when issued. Sadly until a serious system of measurement appears, many of those doing great work in Green or ESG and our own area of SDG may be hidden from view by the large fog that descends as all companies, banks and finance houses claim the high ground, which with their huge war-chests of money they can do with ease. Sadly in recent years, so long as you say something enough times and loud enough, it becomes the truth.

Great point being made by the one and only Greta Thunberg, but how can such large companies get away with this?

This is the crux of the issue. Vanderbilt University law professor Amanda Rose talks about “ESG fuzziness”. With the USA’s SEC looking to also bring in ESG rules, Rose writes of the “vagueness” of ESG definitions which makes it so difficult to identify the most important issues in the topic (here). With such ‘fuzziness’ it is surely guaranteed that ‘Greenwashing’ will move into ‘ESG-washing’.

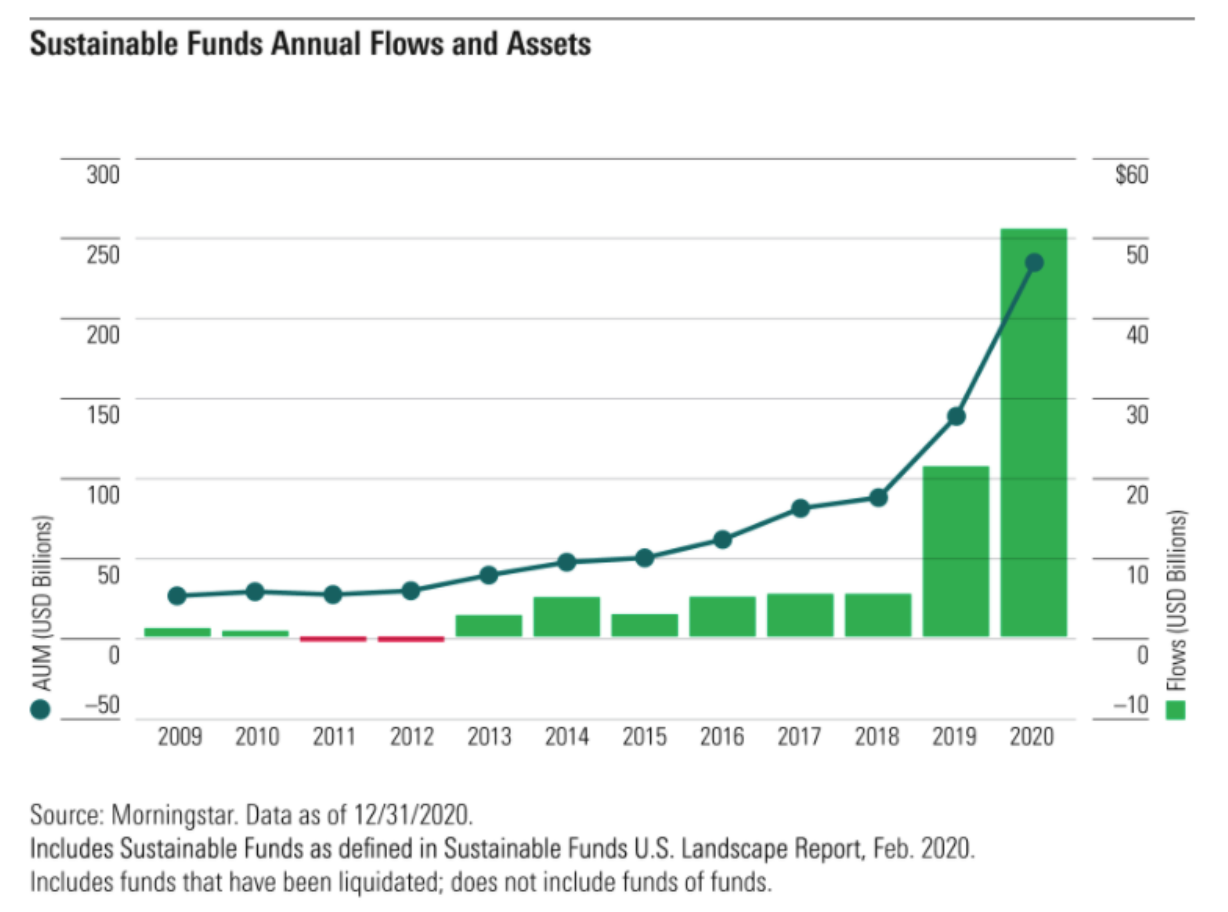

This is not helped by the fact that the market is so desperate for Green and ESG stories, and with so much money chasing these there is now a bidding war. In recent years the value of funds with a ‘Green’ or ‘ESG’ theme has exploded to over $1.6 trillion. That’s a whole load of money chasing a whole load of little. So it is no wonder that the financial press can claim that ‘Green’ or ‘ESG’ investments do so well, the price is rising exponentially with the increased demand as all these funds search desperately for investable assets. It is sadly not because all of these ‘Green’ or ‘ESG’ assets save or make the world a better place (although some do), and that this then creates a massive wave of goodwill to the companies concerned. But for many involved in ‘washing’ this simply increases the price of all such assets and allows them to raise significant sums of money. Perhaps then it was not a surprise that so many funds rebranded themselves as ESG (according to Morningstar, over 250 suddenly became ESG, Green, Socially Responsible, or Sustainable funds in the last quarter of 2020) - just look at this massive wave of investment in ‘sustainable funds’, all chasing the same assets… (here).

So what does this actually mean for us? Well unless you have found a magical way to tap into this wall of money, sadly very little. The reason being that, as we discussed in our letter: “Research? Or simply wing it…”, because there is so little research or data on Africa, it is so often ignored by the large investing world and also corporate world looking to add security and sustainability to their supply chains. This is why when we send you requests for surveys it is so important for you to please spend those five minutes answering the questions. This is exactly what Greta meant by ‘no one is too small to make a difference’. In a world full of noise, we have to build ourselves a platform of research and data from which to be heard.

So how else can we support this move? In a time with so much choice of supply, yet so little of it being used (most look to China as a first port of call, ignoring Africa), we must make our voices heard.

Parallel to these moves on the finance side, so public opinion has raced behind certain issues, one being forced labour and human rights violations. China is the largest cotton producer in the world providing around 20% of the world’s needs. With 84% of its cotton coming from the Xinjiang region, this means that almost all cotton from China is from that region. This region has tragically been in the news recently because according to reports (here), forced labour and human rights violations being perpetrated on millions of Uighur people in this region. This cotton is also used in major garment-producing countries such as Bangladesh, Cambodia and Vietnam. If you have cotton with a clear line of sight (so you can prove origin) to the farm in Tanzania, Uganda or the other Cotton producing countries of Africa, and especially if you are GM-free and organic, now is your chance to start shouting - so many ‘western’ supply chains will need this and fast. If you manufacture with African cotton, now is your time to be heard.

Elsewhere, the supply chain of Plastics has been hit badly as we mentioned in our letter (here). With the EU and UK governments bringing in new regulations banning single-use plastic products, and the United Kingdom taxing plastic packaging with less than 30% recycled materials from 2022, given we have a number of inspirational Lionesses in the recycling business, now is your time. If you are one of these amazing women, collecting and recycling plastics, even more so if you are manufacturing the plastic pellets from recycled plastic then don’t be shy - tell the world!

How can you tell the world? Luckily you happen to be part of a community that is being seriously noticed. With 1.2 million African Female Entrepreneurs as members (and still the fastest growing community), we are now on the preferred suppliers lists of The World Bank, AfDB, Siemens, VW, Unilever to name but a few. As a single woman running a business, it is not easy to be heard. But as a Lioness, part of such a huge community, the effect is just like our photo this week - as a single Starling you will be ignored, but as part of a crowd, or to use the correct collective noun, a ‘murmuration’ of Starlings (see here), you will be certainly be seen and very much heard.

Tell us of your SDG impact and we shall Roar together!

Stay safe.