Startup Story

Helping people to make the right financial life and business decisions is what drives entrepreneur Agnes Chikukwa Hove, founder of Sequor Consulting, in South Africa. Today, her company provides specialist financial training and money management coaching that also builds the confidence needed to make smart financial choices.

LoA chatted to founder Agnes Chikukwa Hove this month to find out more….

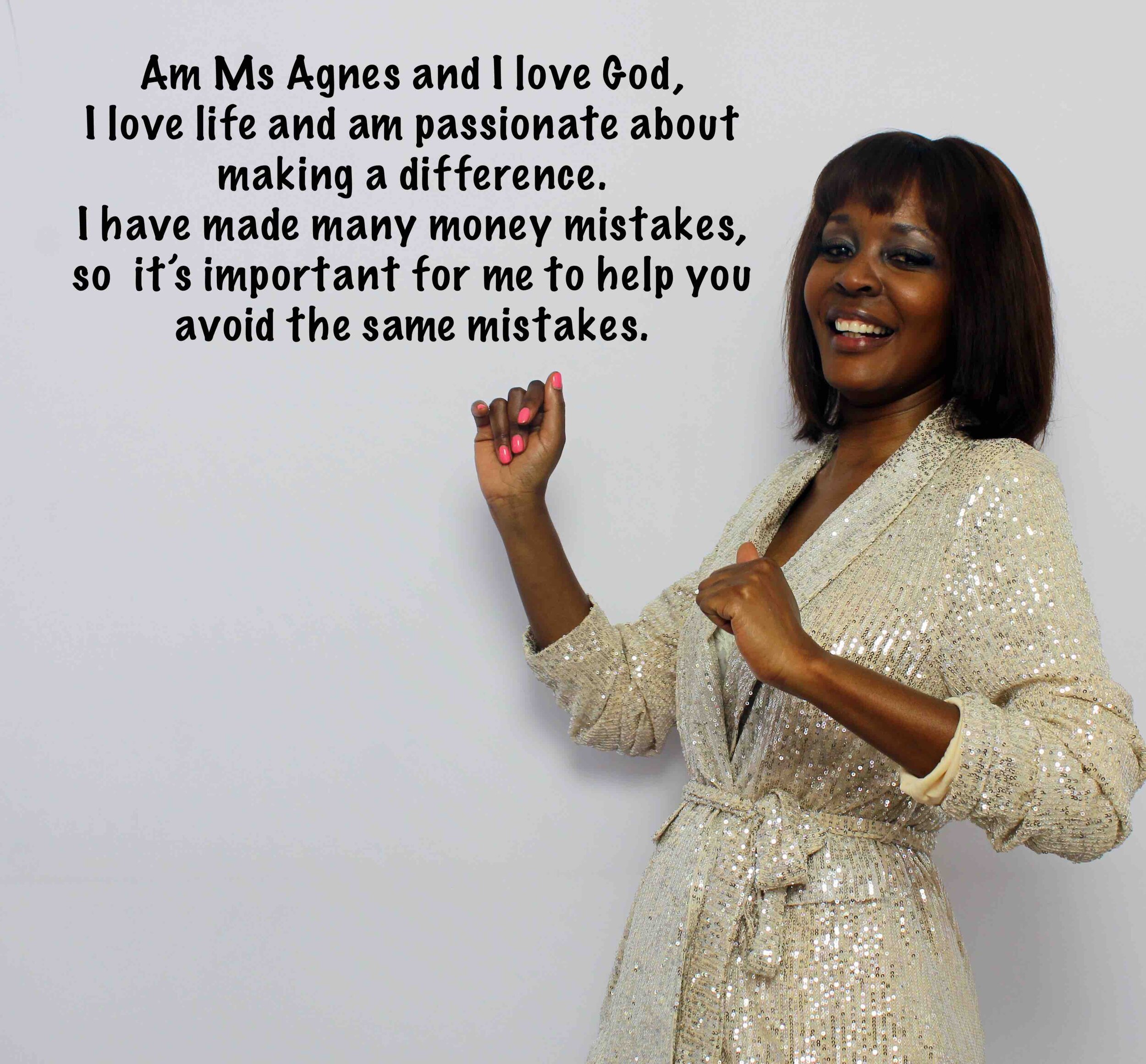

Tell us more about yourself

My name is Agnes Chikukwa Hove, and I find fulfillment in being a Financial Wellness Coach. I coach individuals, couples and organisations on effective personal financial management, and have effectively done so for the past 8 years. I am a seasoned strategist who is currently the Chief Executive Officer of Sequor Consulting, a Pan-African SME Development, Consulting and Advisory organization. I am also the Treasurer at African Women in Agriculture (AWiA) a women’s empowerment organization. I possess a Master of Science (MSc) Degree in Strategic Management, a Business Management (BBA) Degree and a Diploma in Nursing. I also have Management Consulting experience specializing in Strategic Planning, Business / Leadership/ Finance Coaching, Organizational Development, Strategic and Organisational Planning, Business Process Improvement, Employee Wellness and the management of Human Capital. I have over 20 years’ experience as a senior manager within South African companies across a diverse range of industries.

“At Sequor Consulting, we change lives by equipping people with choices that allow them to make better financial decisions.”

What does your company do?

At Sequor Consulting, we change lives by equipping people with choices that allow them to make better financial decisions. We provide Personal Finance Coaching , Consulting and Business advisory services to individuals, couples, entrepreneurs, teams, employees or small groups.

What inspired you to start your company?

Financial worries are the most common cause of stress for both men and women. After having personally gone through a financial slump, making poor financial decisions and then finding solutions, it became my life goal to empower people with the tools to ensure they don't make the same mistakes. Financial wellness is closely linked with physical and mental health, and we all want to enjoy great physical and mental health.

Why should anyone use your service or product?

Our financial training and coaching is not simply about the provision of tools, we do it with passion, using experience and storytelling to bring financial theory to life. Managing money isn't the most fun subject, but our unique model of presentation makes it relatable, and presents an opportunity to empower individuals and entrepreneurs to make better financial decisions. We delve into the psychology of money and explore cultural issues around money management that affect us.

“Financial wellness is closely linked with physical and mental health, and we all want to enjoy great physical and mental health.”

Tell us a little about your team

We collaborate with a select group of highly qualified and experienced facilitators, and we have economists and psychologists on our teams.

Share a little about your entrepreneurial journey. And do you come from an entrepreneurial background?

Both my parents worked, my dad was a journalist and mum was a nurse. They believed in the importance of job security, a 'job for life' and loyalty to an organisation as core life principles. They did not understand my passion for entrepreneurship and wondered why I didn't simply join an organisation which offers the services I want to provide.

My journey as an entrepreneur has not been an easy one, finances are a touchy subject and most people find it uncomfortable to discuss money. However, once the ice is broken, it's amazing to help people demystify financial concepts.

What are your future plans and aspirations for your company?

Growth, and expansion across borders.

“Our financial training and coaching is not simply about the provision of tools, we do it with passion, using experience and storytelling to bring financial theory to life.”

What gives you the most satisfaction being an entrepreneur?

As an entrepreneur, the best gift is to see lives changed. We have witnessed people getting out of debt, finally qualifying to purchase a property, and some paying off their mortgage bonds and this makes me incredibly happy! Financial wellness is a privilege that should be afforded to everyone, and it starts with taking the first step.

What's the biggest piece of advice you can give to other women looking to start-up?

Your life has a purpose. Your story is important. Your dreams count. Your voice matters. You were born to make a difference. You matter.

Contact or follow Sequor Consulting

WEBSITE | TWITTER | INSTAGRAM | EMAIL agnes@sequor.biz

Why LoA loves it….

If there is one core skill that all women entrepreneurs need to master it is the ability to effectively manage finances, yet it can be a big challenge for many. Agnes and her team at Sequor Consulting make the business of managing finances and achieving financial wellness seem like an easier task. She brings her personal experiences of having to effectively manage money better during tough times, and makes learning accessible to everyone. This is one entrepreneur making a difference and changing lives when it comes to money management and financial wellness. — Melanie Hawken, founder & ceo of Lionesses of Africa