Guest blog by James Boorman, Project and Corporate Finance Advisor and Founder of New African Projects and Business Ltd.

In the third of a fascinating series of guest blogs simplifying issues around financial management for all those women entrepreneurs who are looking to import and export in their business, this week the focus is on the importance of having a foreign exchange plan and sticking to it.

We have now discussed the background to Foreign Exchange (FX) and Forwards (if you missed them, check out the blogs on the subject over the past two weeks), so what should an Importer or Exporter do now? How do you price your goods today when you are exposed to FX risks ? If you were to calculate your costs, add a profit margin and then use today’s FX Spot Rate to calculate the invoice amount, I hope that you will by now realise that you are missing something - the forward points or interest rate that will allow you to take into account the cost to you of hedging any future FX exposure.

So what do you actually need ?

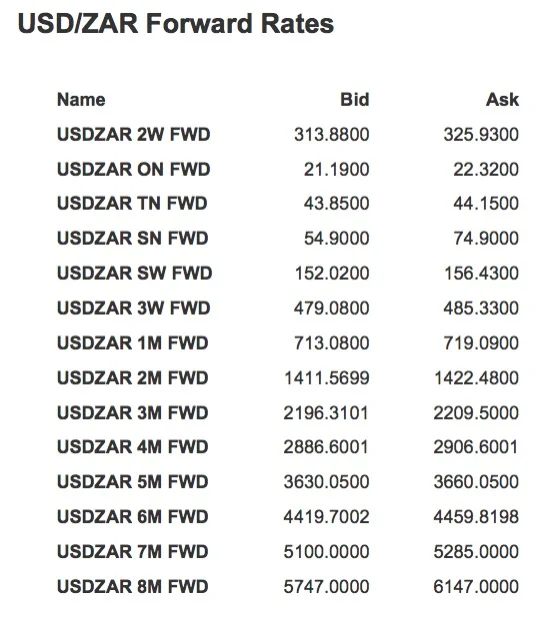

Your bank should provide you with the Forward Points such as these:

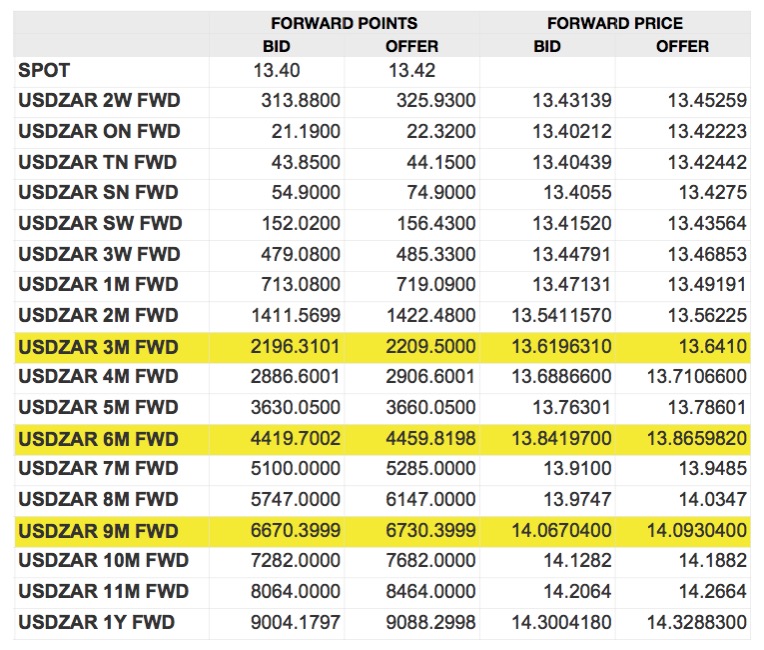

What is useful is to put these into a spreadsheet to calculate out the actual price of the forward needed. Points should be divided by 10000 and then added to the Spot Price.

So ‘Spot’ Bid + (‘Forward Points’ Bid/10000) = ‘Forward Price’ Bid.

Do the same for all the offers.

It should look something like this:

Now you can calculate a price for that Client. As an importer (who has FX exposure until payment is made to the Supplier) you are buying US$ - it is the ‘offer’ you want - ‘bids’ if you are an exporter.

Note as per last week, I mentioned your bank should not add profit onto the forward points as they are getting their profit in the spot spread. Here you can see there is a spread for the ‘Forward Points’ - this is the market spread and it is perfectly fine for your bank to quote this, but not to add on any other profit.

Once you have your spreadsheet, remember these will not be exact quotes as the market will be constantly moving, but quoting a client on a rough but close figure is far better than quoting a wrong figure!

So, when are you exposed to the FX movements?

If your Client has confirmed the order and agreed the price, from that moment onwards you are 100% exposed, this is known as ‘Transaction Exposure’ - the ‘potential exposure’ has become a ‘commitment’. If you have priced everything correctly, added on your profit margin and used the forward price, then why not fully hedge and lock in your profit? If you wait for the spot price to go in your favour, it might not and then you are just playing with your well earned profit margin.

Then there are Economic Risk Exposures (Unconfirmed Purchase Orders and Projected Orders), these may or may not happen, but you will know your Clients better than anyone and can gauge your need for a hedge.

So to your plan:

It might sound a bit grand, but I have found the best plan is to create a formal but small ‘Treasury Committee’. Between all of you, discussions can be had around what you want to achieve (more sleep, less sleep), what your exposures usually are, and when you are exposed to the FX Market. Parameters should be set and then followed to the letter. That is not to say that they cannot be changed after further discussion, but if you happen to leave an order unhedged and the FX market moves against you, you will have to answer to your shareholders as to why, when you should be making say 30% profit on every order, you are now suddenly losing money because of a lack of FX hedge…(believe me, not a good conversation to have).

An example might be:

Expected Maturity /Payment Date Min Cover Max Cover

Transaction Exposures - 1 to 3 months 100% 100%

Economic Exposures - 4 to 6 months 20% 60%

Economic Exposures above 6 months 0% 20%

As Economic Exposures become confirmed orders, so your cover should increase and with it your sleep !

Next week:

Do you know your FOB from your FAS ? Your DAP from your DDP? Incoterms and why they matter to Lionesses...

James Boorman, 22 years in the Financial Markets in London trading many different products from FX to Interest Rates to Commodities to Futures and Options, before being relocated by Credit Agricole in 2007 to Johannesburg as an Investment Banker, Head of their Financial Institutions Department, sub-Saharan Africa. He now spends his time with his family in South Africa whilst advising on Project and Corporate Finance deals. He adds significant value in the foreign exchange value chain to those companies who do not have the necessity or resources to justify a full time Treasury professional or department, but still need to ensure that their market risks are managed (and their sleep patterns undisturbed). Seen here planting Bamboo in Mozambique.

Read more articles by James