Guest blog by James Boorman, Project and Corporate Finance Advisor and Founder of New African Projects and Business Ltd.

In the latest of a series of fascinating and insightful guest blogs that look at issues around financial management for women entrepreneurs, this week our focus is on understanding what exactly you need in your financial armoury and the benefits of shopping around for the right source of banking support.

So: “A Banker will lend you an Umbrella when the Sun is out, never when it is raining…”, whilst the sun is shining let’s get into their good books…

I am not suggesting taking on unmanageable debt - your Debt to Equity ratio (generally - above 3 is dangerous); Debt to Asset ratio (above 60% is not fun) and your Financial Leverage Ratio (keep this low please) will all start to look ugly (we shall cover these next week). In simple terms - it is ok to use some Debt to finance your firm, however each month there will be an interest bill to pay - too high and this will suffocate your business...

Banks want to ‘own’ something of yours they can later sell if needed to recoup their money, and in return they will give you a lower interest rate.

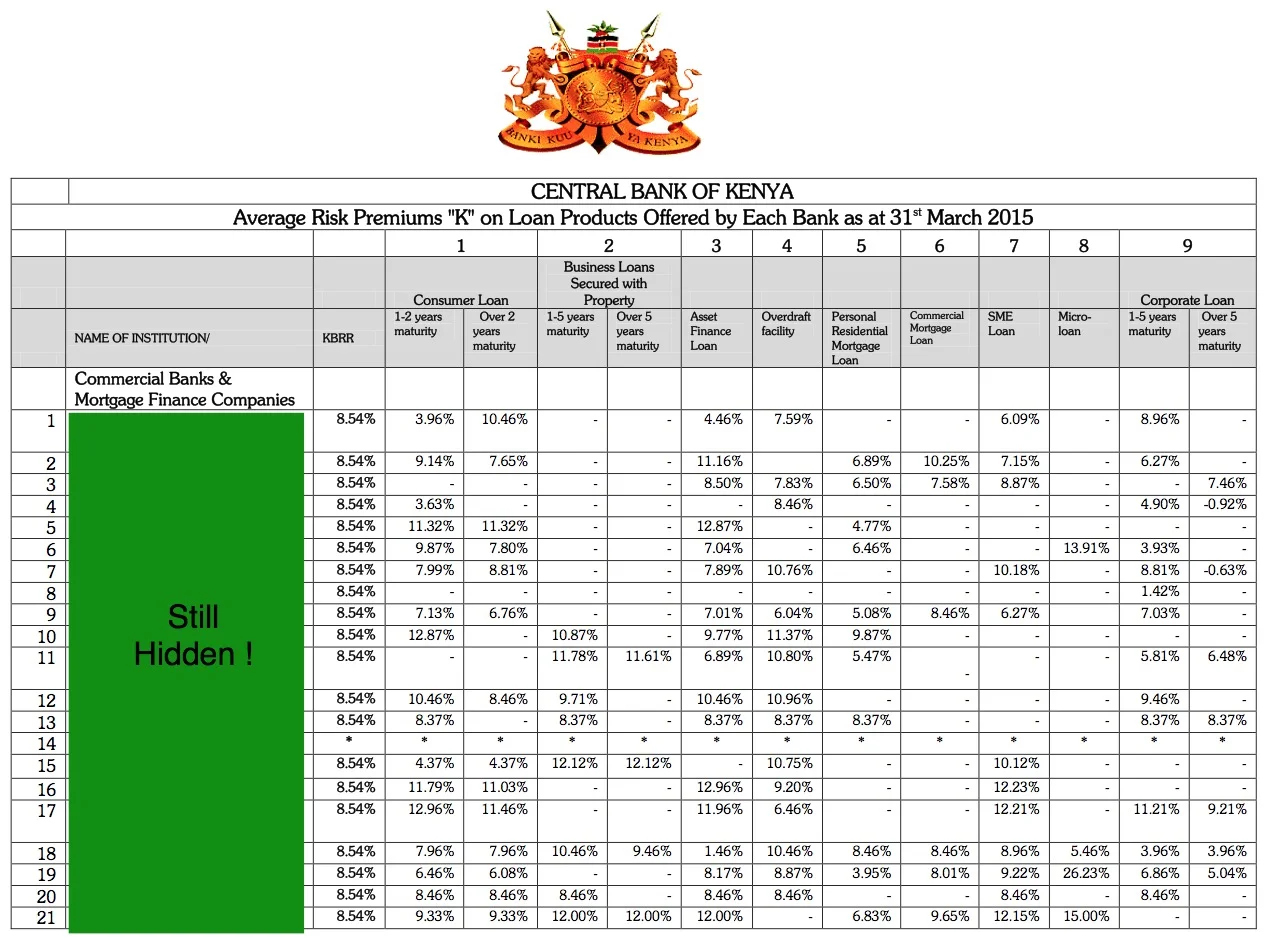

The ‘dance’ is to give your bank as little as possible, in return for the smallest amount of interest… Do shop around - however, your own bank (who knows you the best) should offer you the best rates...

Let’s look again from last week:

Mortgage

If you have a Mortgage on your business property, you should be allowed (‘Never Assume’ - check !) to dip into this if you have previously paid some off. Ultimately you want to bring it down to the minimum needed to keep the Mortgage active. It really is the best way for you to save for a rainy day. Note the ‘Business Loan secured by Property’ (sounds like a mortgage to me !), is actually priced higher than a mortgage, so get that mortgage when the sun is out ! Remember you don’t have to drawdown (take) the full amount - all loans should be used sparingly and for a good reason. Remember, you are not a child suddenly handed the keys to the Sweet Shop !

Note the difference between Commercial and Personal Mortgage rates - it’s easier for a Bank to sell a house than a factory, however it is not recommended to attach your personal home to your business (although some do) because if your business collapses you need something to fall back on and somewhere to live. A failing business will be stressful enough for you and your family without the horrifying prospect of losing your house as well...

Overdraft

Careful of any fees you have to pay on this (as with any fees - these can sometimes significantly increase the overall cost) but it’s a quick and easy product to arrange. A useful tool.

Asset Finance Loan

Your business is booming and you need an extra machine? The bank will happily wrap itself around this. Think of them owning it until you have paid it off - they can and will come and pick it up if you stop paying them, but for the right piece of machinery (good second hand market) the bank will partner you in this.

Invoice Discounting/Factoring

Cash Flow Finance - You invoice your client, he pays in 30-60 days but you need the cash now. Your Bank will take that invoice and immediately pay you a percentage of the value, possibly around 70-80% depending on the risk of the end Client. They then collect, take their interest payment and then return the excess (beware - lenders we spoke of last week will give you the 70% and keep the balance…yes, that’s 30% for a 30 day invoice-backed debt!). Try to arrange for you to collect and pay the Bank (Discreet Factoring) as Clients sometimes worry about your business if they see a Bank collecting (Factoring). If your Bank insists just explain to the Client, it is quite commonly used. Sadly this is not given against invoices to individuals...

Next week: What exactly is your Accountant talking about, and your Banker getting excited over?

James Boorman, 22 years in the Financial Markets in London trading many different products from FX to Interest Rates to Commodities to Futures and Options, before being relocated by Credit Agricole in 2007 to Johannesburg as an Investment Banker, Head of their Financial Institutions Department, sub-Saharan Africa. He now spends his time with his family in South Africa whilst advising on Project and Corporate Finance deals. He adds significant value in the foreign exchange value chain to those companies who do not have the necessity or resources to justify a full time Treasury professional or department, but still need to ensure that their market risks are managed (and their sleep patterns undisturbed). Seen here planting Bamboo in Mozambique.

Read more articles by James