Startup Story

Sothenne is a consultancy company founded by Gisela Massaua in Mozambique and operating in the areas of Financial Education, Personal Development and business and sales intermediation. The business aims to contribute to better financial positioning of people and companies in the Community of Portuguese-speaking Countries. The business has been in the market for 2 years and has developed products and services that can accommodate customers in different segments. Gisela launched two specific products for informal sellers and low-income people, contributing to better financial positioning of people and companies in Mozambique, Angola, Cape Verde and Portugal. Sothenne aims to work with audiences from across the CPLP (Community of Portuguese-speaking Countries) by 2025.

A Sothenne é uma empresa de consultoria actuando na área de Educação Financeira, Desenvolvimento Pessoal e intermediação de negócios e vendas. No mercado há 2 anos, temos desenvolvido produtos e serviços que conseguem albergar clientes em diversos seguimentos tento 2 produtos específicos para vendedores informais e pessoas de baixa renda. Nestes dois anos contribuimos para melhor posicionamento financeira de pessoas e empresas em Moçambique, Angola, Cabo Verde e Portugal e almejamos até 2025 trabalhar com público de toda CPLP (Comunidade de Países de língua Portuguesa)

Lionesses of Africa spoke to founder Gisela Massaua about her vision for the business and the gap in the market for her service offering.

What does your company do? O que faz a sua empresa?

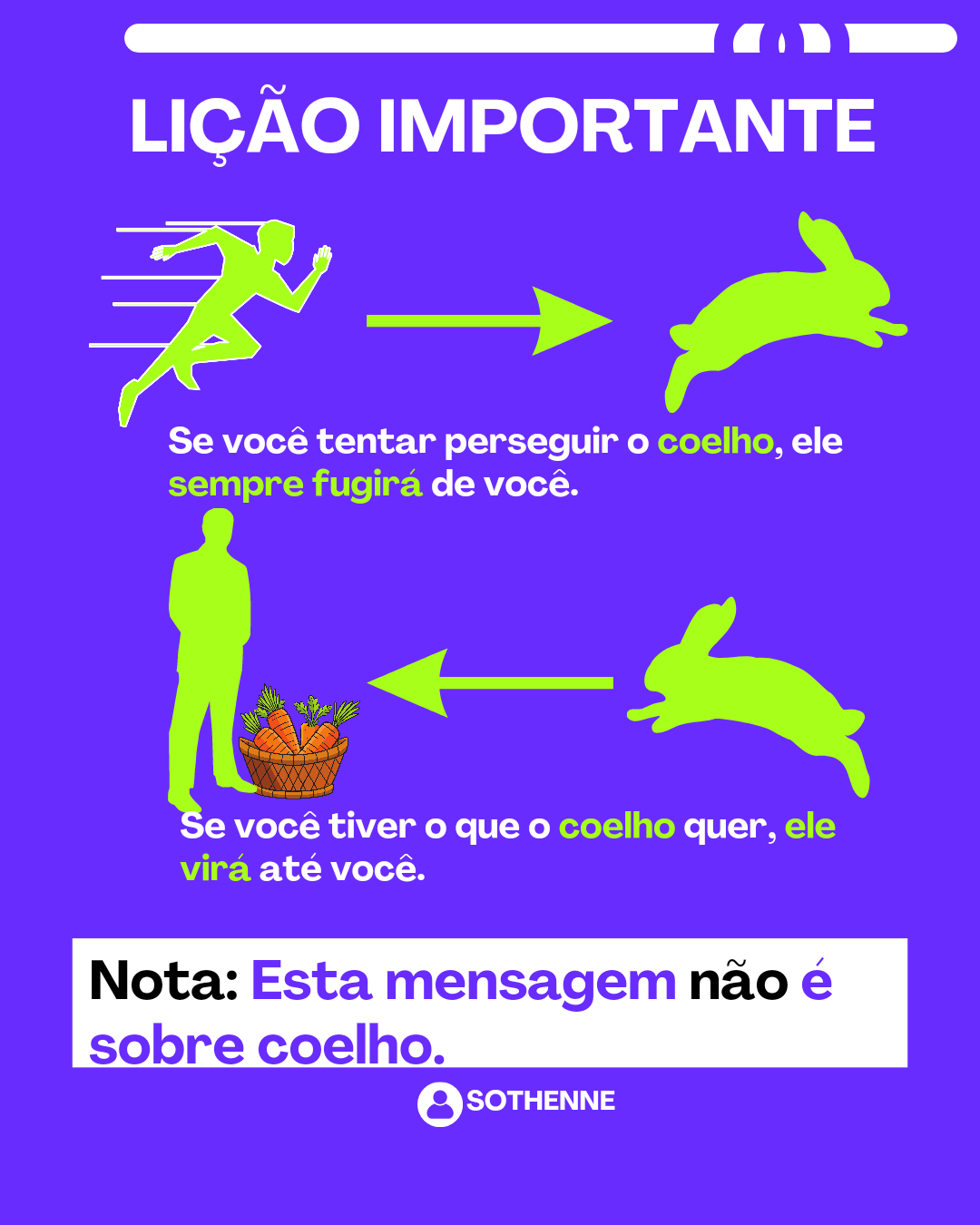

We provide consultancy services in Financial Literacy, Personal Development and Business and Sales intermediation.

Fornece serviços de consultoria em Literacia Financeira, Desenvolvimento Pessoal e intermediação de Negócios e Vendas.

“More than half of the population in Mozambique does not have access to basic financial systems and this scarcity is more notable among women.”

What inspired you to start your company? O que a inspirou a iniciar a sua empresa?

More than half of the population in Mozambique does not have access to basic financial systems and this scarcity is more notable among women. However, the small population that has access to financial services does not know how to use it in order to optimize their finances. Added to this, the low level of financial literacy means that many people live in debt.

Mais da metade da população em Moçambique não tem acesso a sistemas financeiros básicos e essa escassez é mais notável nas mulheres, entretanto a pouca população que tem acesso aos serviços financeiros não sabe como usar de forma a optimizar as suas finanças. Acrescido a isto, o baixo índice de literacia financeira que faz com que muitos vivam em situação de dívidas.

Why should anyone use your service or product? O que torna a sua empresa, serviço ou produto especiais?

The simplification of processes, terms and information adapting to the reality of the target audience, so anyone, even if they do not have high levels of education, can access information in a clear, concise, and precise way.

A simplificação dos processos, termos e informação adequando a realidade do público alvo, assim qualquer pessoa mesmo que não tenha altos níveis de escolaridade consegue ter acesso a informação de forma clara, concisa e precisa.

“We intend to be able to work with the entire CPLP (Community of Portuguese Speaking Countries) by 2025 and implement two financial literacy projects for rural people, informal sellers, and low-income people who until now have remained on paper due to lack of funds.”

Tell us a little about your team. Fale-nos um pouco sobre a sua equipa.

My team is made up of 3 people. In addition to me, who is the Financial Educator and CEO, there is a Content Assistant, and two salespeople.

A minha equipe é formada por 3 pessoas. Além de mim que sou a Educadora Financeira e CEO, tem um assistente de Conteúdo, e dois vendedores.

Share a little about your entrepreneurial journey. And do you come from an entrepreneurial background? Partilhe um pouco da sua jornada empresarial. Tem algum historial de atividade empresarial?

I started entrepreneurship at the age of 8. However, it was only in 2020 at the age of 26 that I decided to undertake a formal business by creating Sothenne.

Comecei a empreender aos 8 anos de idade, entretanto só em 2020 aos 26 anos decidi empreender de forma formal criando a Sothenne.

What are your future plans and aspirations for your company? Quais os seus planos e aspirações futuros para a sua empresa?

We intend to be able to work with the entire CPLP (Community of Portuguese Speaking Countries) by 2025 and implement two financial literacy projects for rural people, informal sellers, and low-income people who until now have remained on paper due to lack of funds.

Pretendemos até 2025 conseguir trabalhar com toda CPLP( Comunidade de Países de Língua portuguesa) e colocar dois projectos de literacia financeira para pessoas rurais, vendedores informais e pessoas de baixa renda que até agora encontram-se no papel por falta de fundos.

What gives me the most satisfaction is to see the financial transformation in the lives of those who use our services.

What gives you the most satisfaction being an entrepreneur? O que lhe dá mais satisfação enquanto empreendedora?

See the financial transformation in the lives of those who use our services.

Ver a transformação financeira na vida daqueles que usufruem dos nossos serviços.

What's the biggest piece of advice you can give to other women looking to start-up?

Qual o maior conselho que pode dar a outras mulheres que pensam abrir uma empresa?

Start with what you have, the best time to start is now. If God gave you a business idea, He will find customers for you.

Comece com o que tem, o melhor momento para iniciar é agora. Se Deus te deu uma ideia de negócio, Ele irá arranjar clientes para si.

Find out more:

Email sothennelda@gmail.com

Website http://www.sothenne.com

Facebook https://www.facebook.com/Sothenne?mibextid=ZbWKwL

Instagram https://instagram.com/sothenne?igshid=MzNlNGNkZWQ4Mg==

Why LoA loves it….

So many women entrepreneurs are driven to find solutions to key challenges or problems that exist in their communities and countries and it’s why they start businesses. For Gisela Massaua, she recognised that the lack of financial literacy and access to basic financial systems, particularly amongst women, is holding them back from fulfilling their potential and contributing fully to society. Her business aims to address that gap by helping people to financially transform their lives through literacy and education. Inspirational! — Melanie Hawken, founder & ceo, Lionesses of Africa