Guest blog by James Boorman, Project and Corporate Finance Advisor and Founder of New African Projects and Business Ltd.

In the latest of a series of guest blogs that look at issues around financial management for women entrepreneurs, this week our focus is on understanding the numbers in our businesses.

What joy! We move onto the numbers side of running your business. Either you love accounting, you begrudgingly appreciate what it brings to the table, or you hate it. Personally, I am more on the Finance side (I love the simple things in life) rather than Accounting. Accountants track things, Financiers use that information to cut costs, increase revenue and increase the bottom line (see - far more exciting !).

So the ‘fearful’ Accounting Equation:

Assets = Liabilities + Equity

Or as I like to think:

What I have = What I owe + What I own

Let’s have a look at your truck taking those beautiful baskets to market in Lagos.

It cost ₦ 6 million, you borrowed ₦ 4 million from the bank and you put in the ₦ 2 million difference…

So:

...nothing too difficult there !

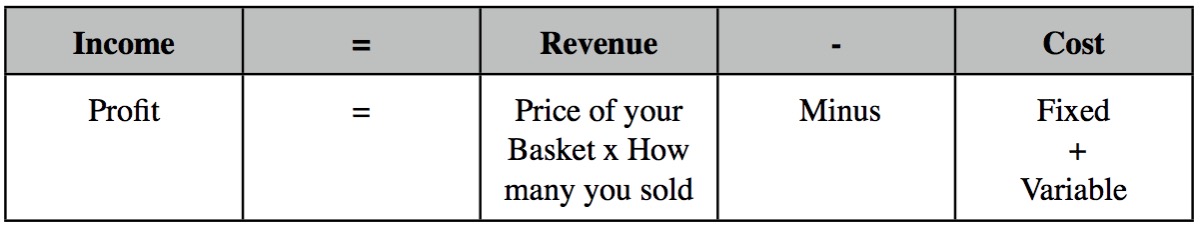

So move to my side, the Finance part:

Fixed Costs? These are costs you have to pay each month even if you produce nothing - e.g. rent and monthly salaries. Variable? These are the costs that go up and down depending on how busy you are - hourly rate employees, cost of materials… So, I can increase my Profit by increasing the Price or Volume OR by cutting my costs - moving Fixed Costs to Variable is often used - i.e. I am happy to pay my employees when they are producing more (increase their hours) than on a monthly salary where I shall have to pay them even if I sell nothing and they stand idle. Obviously nothing is ever so clear cut, but at least once written down, answers can start to appear.

So what will your friendly banker be looking for when you start your dance for funding…

1. You must know your financial position (practice answering in the mirror…). To start, he/she will want 4 basic statements:

- Balance Sheet (Assets = Liabilities + Equity)

- Income Statement (Income = Revenue - Costs)

- Cash Flow Statement (Tracks the cash)

- Shareholder’s Equity (Shows the type of Equity in the Company - as above the cash that was used for your Truck, plus items such as Retained Earnings, plus as per last week if you paid money into your factory’s Mortgage for that rainy day).

2. That you know exactly why you want the money (your Banker will want to know your plans).

3. Exactly because they do not want you to take on too much debt, they will look at your figures and use some very interesting ratios...

Ratios.

There are 5 Main Categories:

- Liquidity

- Solvency

- Cash Flows

- Profitability

- Activity

It is very important you know what they all mean - remember a Banker may not just ask ‘What is your Quick Ratio’ but might ask: ‘Can you meet your short term needs?’

There are too many to cover in this week’s letter, so this week I shall start with No.1:

Liquidity Ratios.

The main one here is the Current Ratio, which is:

Current Assets ÷ Current Liabilities

If ‘What I Have’ =’s or is less than ‘What I Owe’, this is not a good position to be in… (I am being kind here - it’s actually awful).

All the other Liquidity Ratios show the same thing but move closer to Cash. The Quick Ratio or ‘Acid Test’, ignore your Inventories and therefore anything above 100% is comfortable (less than 70% and perhaps you are in the wrong business).

Cash Ratio - values Cash against your Liabilities. If your debts were called today - how much would you be able to pay ? Very few companies have enough ready cash, or things near to cash (e.g. Government Bonds), so don’t worry about being below 100%, in fact since my student days I have turned against this - it is quite useless for a company to hold large amounts of cash - are you really saying you can’t put it to better use ?

Next week, more fun Ratios !

James Boorman, 22 years in the Financial Markets in London trading many different products from FX to Interest Rates to Commodities to Futures and Options, before being relocated by Credit Agricole in 2007 to Johannesburg as an Investment Banker, Head of their Financial Institutions Department, sub-Saharan Africa. He now spends his time with his family in South Africa whilst advising on Project and Corporate Finance deals. He adds significant value in the foreign exchange value chain to those companies who do not have the necessity or resources to justify a full time Treasury professional or department, but still need to ensure that their market risks are managed (and their sleep patterns undisturbed). Seen here planting Bamboo in Mozambique.

Read more articles by James