Guest blog by James Boorman, Project and Corporate Finance Advisor and Founder of New African Projects and Business Ltd.

In the latest of a series of guest blogs that look at issues around financial management for women entrepreneurs, this week our focus is on getting a better understanding of ratios.

What are they for?

Do we only need to calculate them the day before we sit down with our friendly Banker?

They are essential tools for management. If, as we saw last week your Liquidity Ratios start falling and move below the panic line (i.e.‘What I Owe’ is more than ‘What I have’), then you as management need to start asking questions, fast.

Solvency

Can I repay my debts and even take on more ? A balancing act…

Debt ÷ Equity or how much I owe in comparison to what I own. Companies with high fixed assets (Factories) will generally have a lower ratio, but still anything above 3 (3x more Debt than Equity) is considered in the danger zone.

Debt ÷ Assets or how much I owe in comparison to what I have. A result of 0.3 would tell you that 30% of your Assets are financed through Debt. Moving above 60% and start to worry….

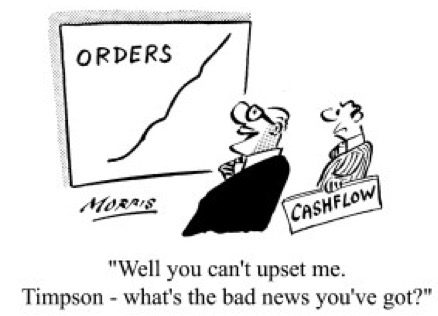

Cash Flow

Cash Flow is like Oxygen to the body, your business might be fit and healthy but a lack of Oxygen can kill off your business faster than you can ever believe possible. Profits, Turnover, Assets and Liabilities mean nothing if you cannot generate Cash Flow (see my ‘Dark Side of Compound Interest’ letter to see the panic some sadly got into with a lack of Oxygen).

Cash Flow from Operations ÷ Net Revenues - The cash generated for each US$ of Revenue.

Cash Flow from Operations ÷ Average Total Assets - just how efficient are your operations? Does your Truck just sit in the corner and do nothing ? A low ratio is a warning sign, start up the motor or sell it!

Profitability

Hopefully you won’t need a magnifying glass to find this (!), but what is a good profit, is your business fit and running on all cylinders or has it got lazy in its old age…

Profit, so the higher the result the better!

Net Profit Margin:

Net Profit after Taxes ÷ Net Sales - so just how much Profit do you keep after all the boring bits have been taken care of such as operating expenses, creditor interest payments and taxes ? The higher the number the more efficient your company. Useful for comparison against your competitors, are you more efficient? Is the downturn effecting everyone the same?

ROE - Return on Shareholders Equity:

Net Income - Taxes - Interest ÷ Shareholders’ Equity

If I gave you ₦1,000,000 for a year and asked you to invest it, I wouldn’t be very impressed if in a year you just handed me ₦1,000,000 back,. It is the same with Shareholders in your company. “We’ve given you the money, now use it !” All shareholders want to see a high ROE, so should you.

ROA - Return on Assets:

How efficient are you with your Assets?

How well are you using your company’s resources?

Net Income ÷ Total Assets

Have expensive infrastructure? Expect a low ROA.

Service industry with a laptop and two cups of coffee? The sky is the limit…

Activity

….sad but true.

How fast is blood flowing around your system?

No good if you supply a client and he sits on the payment for months…

Day Sales Outstanding (DSO):

(Receivables ÷ Sales) x Days in Period

How quickly do your clients pay you?

The lower the better for your Cash Flow.

The opposite being true when you pay your suppliers:

Day Payables Outstanding (DPO):

(Payables ÷ Sales) x Days in Period

Finally - if you have a massive warehouse, are your inventories gathering dust?

Day Inventories Outstanding (DIO):

(Inventory ÷ Sales) x Days in Period

Bring them all together and you see how quickly that $100 you spent on making baskets gets back into your hands:

Cash Conversion Cycle = DIO + DSO - DPO

Explain to your Sales Team why these ratios make a huge difference to your business. If a client wants 60 days credit, sometimes it is just better to offer a discount to bring the money in sooner...

Next week: Legal Documents and why thinking like Tammy Wynette (D-I-V-O-R-C-E) is good for your health.

James Boorman, 22 years in the Financial Markets in London trading many different products from FX to Interest Rates to Commodities to Futures and Options, before being relocated by Credit Agricole in 2007 to Johannesburg as an Investment Banker, Head of their Financial Institutions Department, sub-Saharan Africa. He now spends his time with his family in South Africa whilst advising on Project and Corporate Finance deals. He adds significant value in the foreign exchange value chain to those companies who do not have the necessity or resources to justify a full time Treasury professional or department, but still need to ensure that their market risks are managed (and their sleep patterns undisturbed). Seen here planting Bamboo in Mozambique. You can follow James on Twitter.

Read more articles by James