Guest blog by James Boorman, Project and Corporate Finance Advisor and Founder of New African Projects and Business Ltd.

In the latest of a series of guest blogs that look at issues around financial management for women entrepreneurs, this week our focus is on legal documents.

Law - learn to love it, always respect it.

I have sadly found that far too many do not take legal documents seriously. Many sign documents without recognising the responsibilities contained within, some even sign without reading them!

Never, ever make the mistake that so long as both parties have the same that’s fine.

REMEMBER: What is right for you is right for you !

So, how do we approach all legal documents ?

Firstly, all draft documents should be sent to you in ‘Word’ format, to send in ‘PDF’ is very rude (suggests you have no option but to sign). Likewise once you have your ‘Word’ document you should track any changes you make (very rude not to, as suggests you are hiding your changes) and send back with your comments - keep them polite, you are after all wanting to work with the other party !

Cardinal Rule:

Put aside enough time to read it. Really - read it, line by line. What does each line and clause mean? How will each effect me? I know that every legal document has a mistake in it somewhere - try to find it...

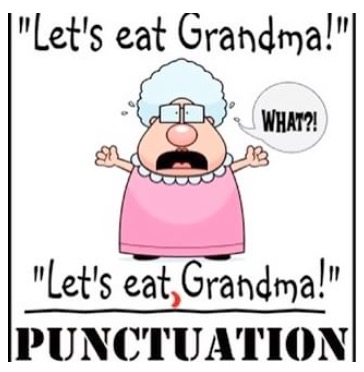

PLEASE concentrate on commas…

Yes, it’s great to be wanted. Yes, you can see the huge advantages of joining forces. Yes, the money it brings will make a huge difference to your Cash Flow, to your business, to the new factory you can imagine in your head… BUT… The next time, the very next time that this document will be taken out and studied will be when something is going wrong, therefore never approach a legal document wearing the rose tinted glasses of a marriage proposal.

Always review the document from the basis of D-I-V-O-R-C-E. How will I be protected?

What are my responsibilities? What are my roles - can I really fulfill them? What really is my share (calculate this carefully from the legal document, not from your meeting notes).

So, what legal documents are you likely to come across?

Let’s start at the beginning.

Sadly ‘My Word is my Bond’ is long gone. However much trust between the parties, as soon as possible after the handshake, get the deal down in writing. Every trustworthy person has a company behind them and what is right today for the company is not necessarily so the next day…

Non Disclosure Agreement (NDA): Usually the first thought that crosses the mind - will the other party steal my clients, employees, suppliers, technical information? Most large companies will have an NDA so you don’t have to design one - just make sure that once it covers what YOU want, that it is equal for both parties.

Roadmaps: (Where are we going? Generally non-binding guides to what goes into the final contract)

Letter of Intent (LOI): (yes, it is a letter) This gives a very good idea of what was discussed, agreed and the basics of the deal. Generally non-binding but you can put in certain binding clauses, such as non-disclosure (saves you time in having to negotiate a full NDA as above); exclusivity (buying a company? Once you start your due diligence all sorts of Vultures will arrive - 12 month exclusive would be a binding clause here); Governing Law - usually your local law - be careful if not as it will be expensive to go to arbitration internationally, and finally any restrictions you need such as control of sectors. Feel there should be extra added? As all good divorce lawyers will tell you - never assume and get it written down!

Term Sheet: This is as above but less binding (unless it says otherwise!) as all important information is in list form. Ensures there are no misunderstandings about price; interest rates; type of cash raising; percentage stake and timings etc. Generally used for financing.

Heads of Agreement: Again non-binding (unless it says otherwise!) and generally used as a guideline to a potential partnership with roles and responsibilities.

As always “The Devil will be in the Detail” and this we shall discuss further in next week’s letter as we move onto ‘Memorandums’, ‘Contracts’ and then and only then Champagne !

James Boorman, 22 years in the Financial Markets in London trading many different products from FX to Interest Rates to Commodities to Futures and Options, before being relocated by Credit Agricole in 2007 to Johannesburg as an Investment Banker, Head of their Financial Institutions Department, sub-Saharan Africa. He now spends his time with his family in South Africa whilst advising on Project and Corporate Finance deals. He adds significant value in the foreign exchange value chain to those companies who do not have the necessity or resources to justify a full time Treasury professional or department, but still need to ensure that their market risks are managed (and their sleep patterns undisturbed). Seen here planting Bamboo in Mozambique. You can follow James on Twitter.

Read more articles by James